The Central Bank of Nigeria (CBN) has announced a major overhaul of its cash-handling regulations — raising withdrawal limits and removing deposit caps — in a sweeping policy shift scheduled to take effect January 1, 2026.

Abuja, Nigeria — December 4, 2025

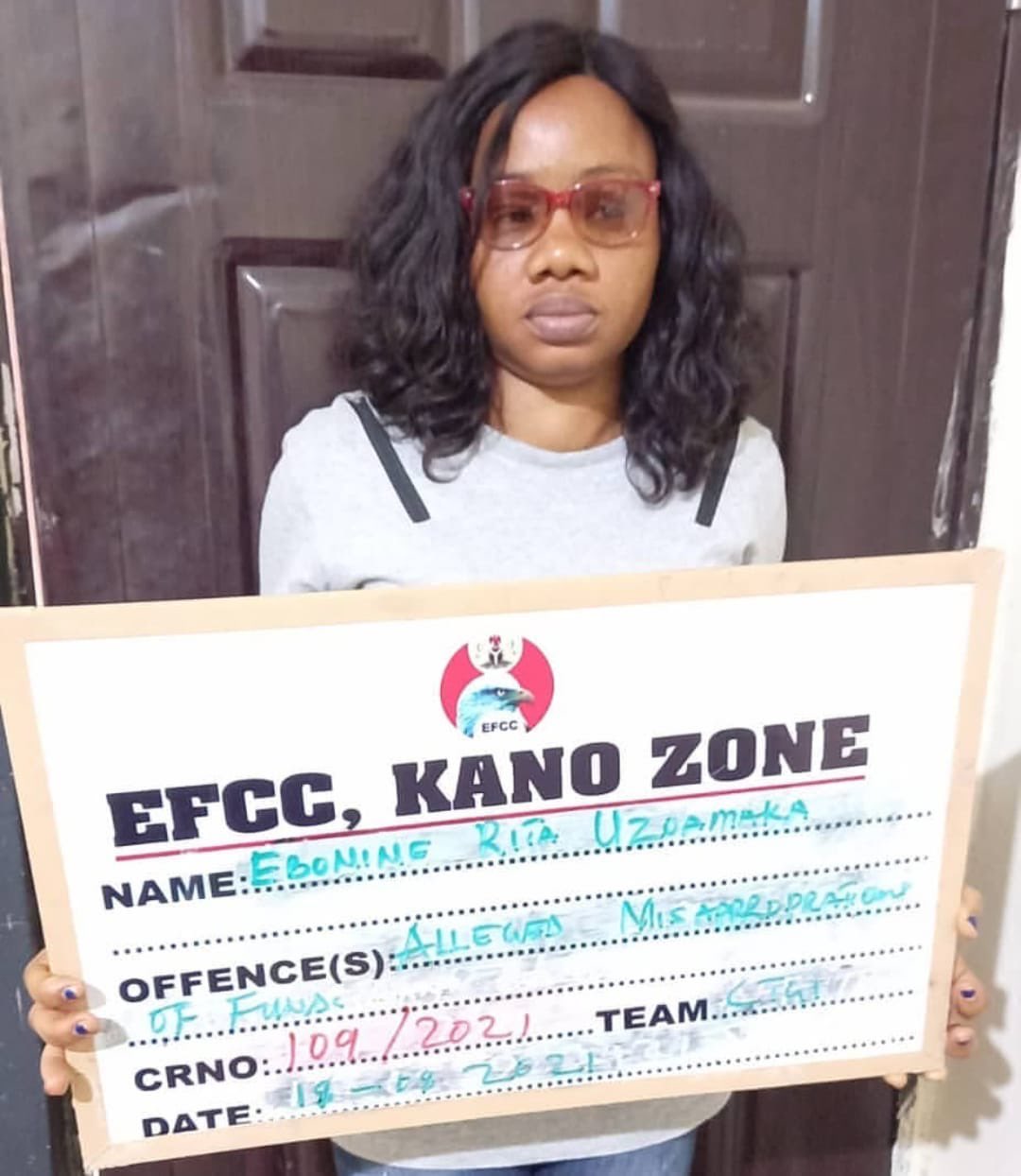

In a circular signed by Dr. Rita I. Sike, Director of the Financial Policy & Regulation Department, the CBN detailed the following key adjustments:

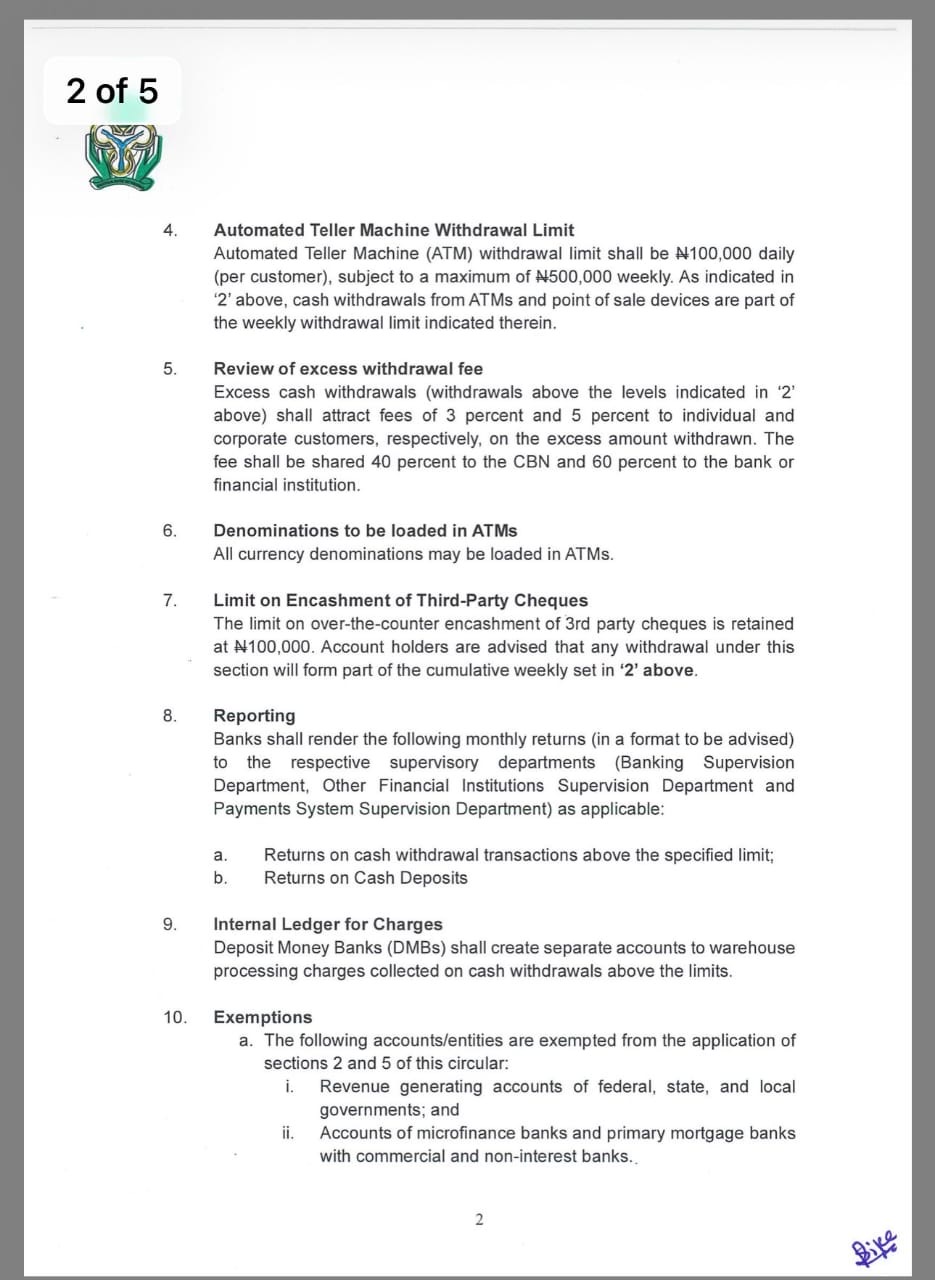

Weekly cash withdrawals for individuals will rise from ₦100,000 to ₦500,000 across all channels (ATMs, POS, over-the-counter).

For corporate entities, the weekly withdrawal limit increases to ₦5,000,000, up from ₦500,000.

Cash deposits will no longer be capped — all restrictions and processing fees on deposits are removed.

ATM withdrawals will be capped at ₦100,000 per day, but still count toward the new ₦500,000 weekly limit.

The previous special monthly authorisation that allowed large one-off withdrawals (₦5 million for individuals, ₦10 million for corporates) has been abolished.

Excess withdrawals beyond the new caps will attract charges: 3% for individuals, 5% for corporates. Fees collected will be shared between CBN and operating banks.

According to the CBN, the revisions are driven by a need to respond to present-day economic realities: rising cost of cash management, security risks associated with handling large volumes of physical currency, and the desire to streamline Nigeria’s cash-usage framework.

Earlier policies — introduced to curb cash dominance and money-laundering risks — had imposed strict limits on withdrawals and deposits. But with changing conditions, the CBN says a more balanced, flexible approach is now necessary.

Individuals can now access up to ₦500,000 per week in cash — a fivefold increase — giving greater flexibility for personal and business expenses.

Businesses and corporate accounts get a significantly higher weekly withdrawal ceiling, easing liquidity constraints for firms operating largely in cash.

Unlimited deposits — without caps or fees — should encourage more cash flow through formal banking channels, reducing reliance on informal cash handling.

More convenience: daily ATM withdrawals up to ₦100,000 provide easier access to cash, while the weekly cap ensures some control over cash circulation.

Warnings in place: withdrawals beyond set limits will incur fees, and banks have been instructed to monitor/report transactions above thresholds.

While the new policy eases access to cash, it doesn’t eliminate all restrictions. Frequent or large withdrawals may attract charges. Also, some previous exemptions — such as those for embassies, diplomatic missions, and donor agencies — have been removed.

For many Nigerians — especially small businesses, traders, and ordinary citizens reliant on cash — this shift could offer much-needed relief and greater financial flexibility. At the same time, the CBN’s move signals a continued effort to balance liquidity, security, and formalization of cash flows in Nigeria’s economy.