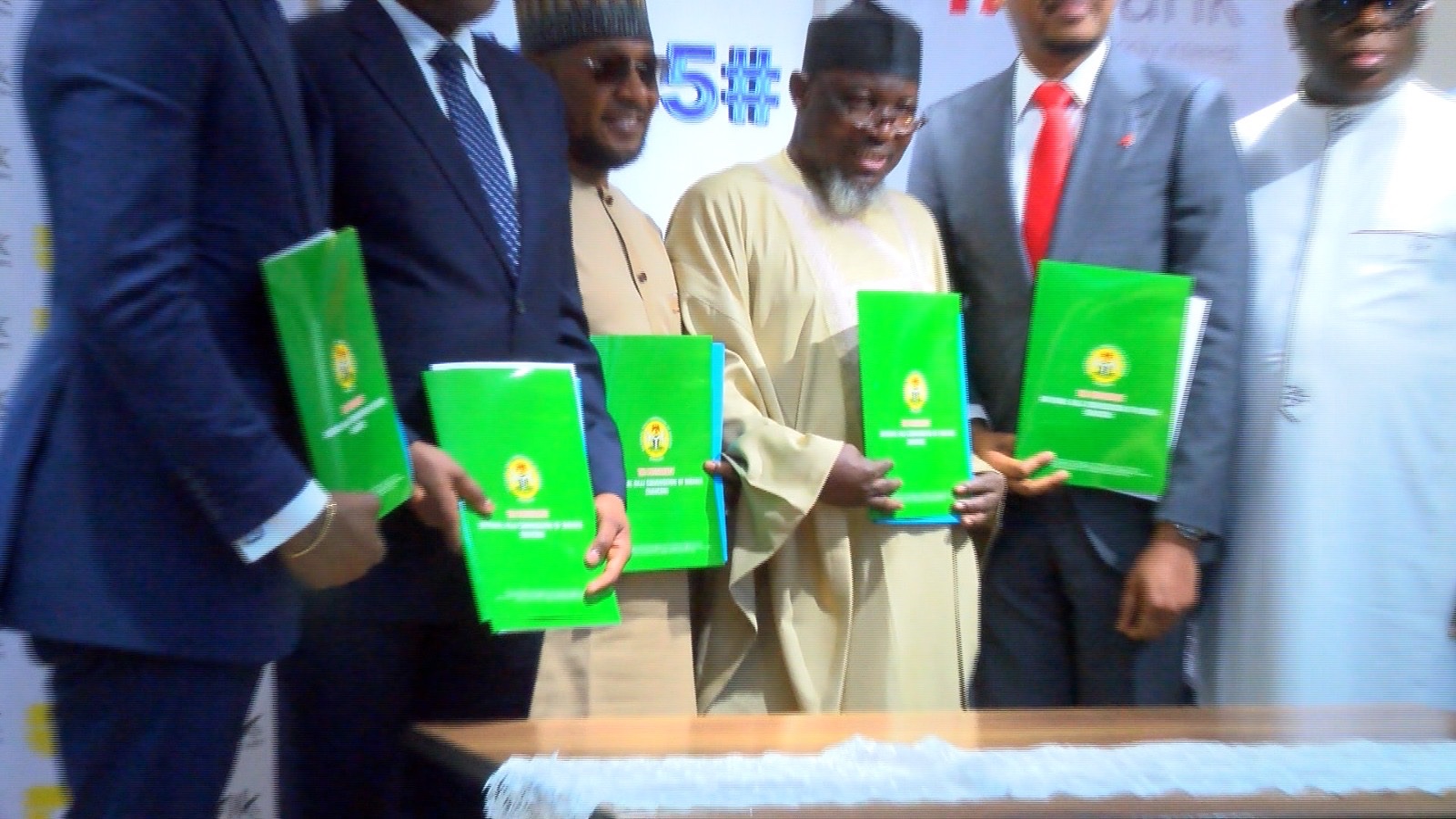

The National Hajj Commission of Nigeria (NAHCON) has taken a major step to make the pilgrimage-saving process more accessible and inclusive by signing a new agreement to expand its Hajj Savings Scheme (HSS) beyond a single bank.

Abuja, Nigeria — December 3, 2025

Under the newly signed Memorandum of Understanding (MoU), four banks — Alternative Bank, Jaiz Bank, Lotus Bank and TAJ Bank — are now authorised to operate the HSS nationwide.

A New Era of Access, Transparency and Inclusion

With this expansion, NAHCON aims to transform the pilgrimage-saving culture among Nigerian Muslims. Under the agreement, each participating bank will:

Launch user-friendly, digital registration portals for intending pilgrims.

Manage deposit and savings funds strictly in line with Islamic-finance principles.

Provide transparent, secure and accessible savings accounts across the country — giving more Nigerians access to structured saving regardless of where they live.

According to NAHCON’s Chairman, Abdullahi Saleh Usman, the expanded HSS will provide a “structured pathway” to help prospective pilgrims plan early. He emphasised that many Nigerians are willing to participate, but lack of awareness and limited access have held them back.

Why the Expansion Matters

Previously, HSS participation was constrained by a limited banking partner network, which limited nationwide reach and meant many intending pilgrims had to depend on informal savings or lump-sum payments. The expansion addresses several critical issues:

Geographical reach — With multiple banks on board, Nigerians from different regions — including rural and underserved zones — now have better chances of accessing HSS services.

Flexibility & convenience — Digital portals allow pilgrims to register and manage savings from anywhere, rather than travelling to a central bank or office.

Financial inclusion — By offering interest-free (or Sharia-compliant) savings accounts, HSS aligns with Islamic values and opens the door to Muslims who may have avoided interest-bearing products.

Transparency & trust — The MoU requires clear roadmaps, periodic reviews, and oversight to protect pilgrims’ deposits and ensure accountability.

As one HSS official put it: when properly implemented, the scheme can make Hajj savings as seamless — if not smoother — than similar programs in countries that have long allowed systematic budgeting for pilgrimage.

What’s Next: Awareness, Outreach and Implementation

The success of this expanded HSS depends heavily on public awareness and participatory uptake. To that end, NAHCON plans to intensify sensitization efforts — using religious scholars (ulama), traditional media, digital platforms, and social-media outreach to educate Nigerians about the benefits of HSS.

The partner banks have also committed to deploying their digital systems quickly and ensuring user-friendly interface and secure account management.

In the words of one of the bank executives present at the signing, the collaboration aims to make Hajj “a whole new experience” for Nigerian pilgrims — less stressful, more predictable, and within reach for many more believers.

What This Means for Intending Pilgrims

For hopeful pilgrims across Nigeria, the expanded HSS signals a turning point:

You no longer need to rely on personal savings or informal arrangements; a regulated, Sharia-compliant banking framework now offers a safe, structured saving option.

Early planners can spread their Hajj savings over time, reducing the financial burden of lump-sum payments.

With digital registration portals, physical distance to major cities or the Commission’s headquarters is no longer a barrier.

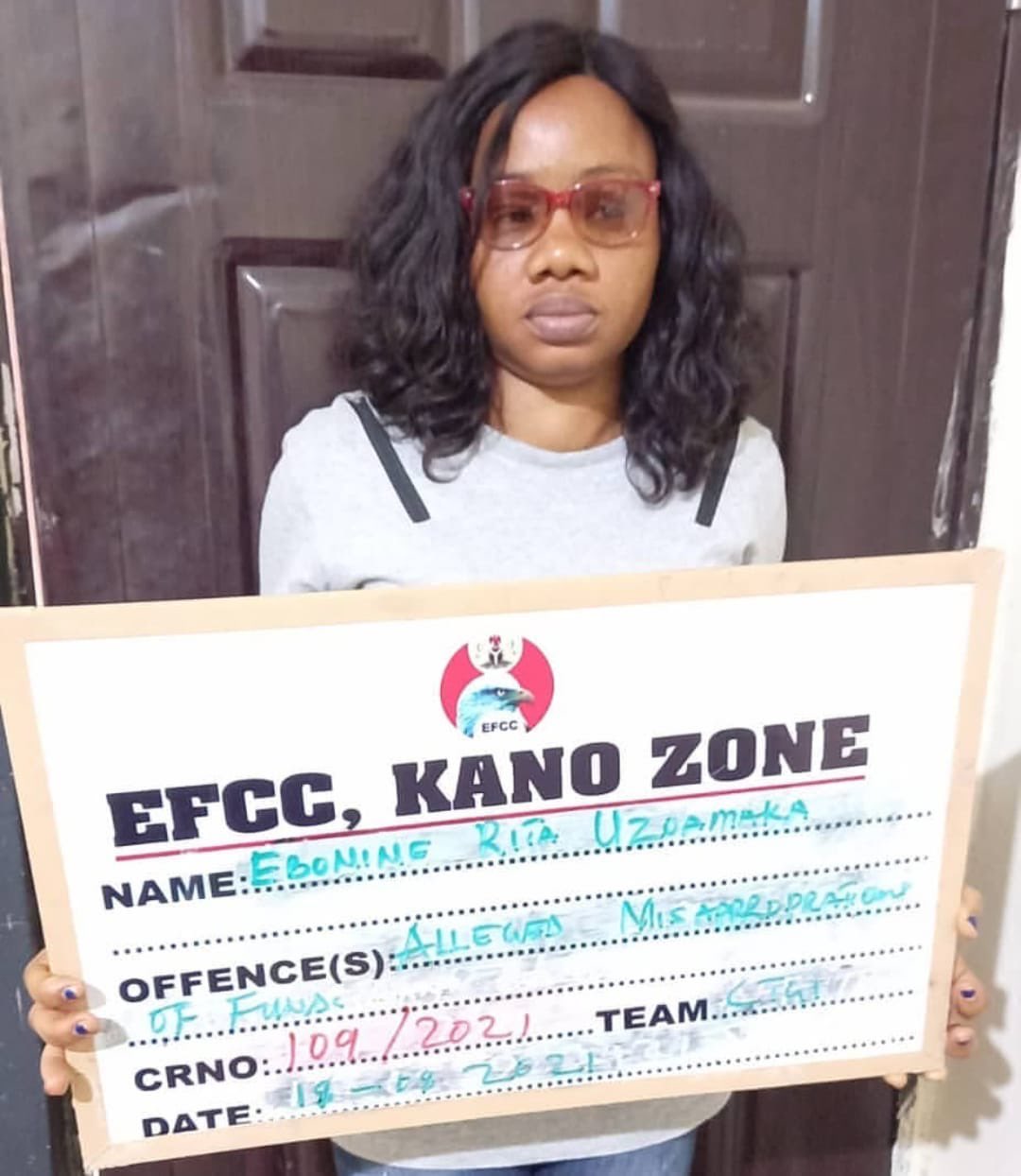

The increased transparency and oversight reduce the risk of fraud or “loss of funds,” offering peace of mind for depositors.

Overall, the MoU signed on December 3, 2025, in Abuja between NAHCON and the four banks marks a pivotal milestone in Nigeria’s Hajj infrastructure. By expanding the Hajj Savings Scheme beyond a single bank and embracing modern banking and digital tools, NAHCON is charting a course toward greater inclusivity, convenience, and dignity for thousands of Nigerian Muslims seeking to fulfill the pilgrimage.